LUMI AGENT: The Autonomous AI Trading Agent for Crypto Markets

Institutional Whitepaper v1.0

Table of Contents

- Executive Summary

- Market Opportunity & Industry Context

- Vision, Philosophy & Core Principles

- Problem Statement & User Needs

- LUMI Ecosystem Map

- AI Market Intelligence Engine

- Technical Analysis Module

- Token Analytics & Whale Tracking

- Social Narrative & Sentiment Engine

- Tokenomics & Incentive Design

- Multilingual Expansion Strategy

- Roadmap & Milestones

- The Future Vision

Executive Summary — LUMI AGENT

LUMI Agent is the first fully autonomous, multi-platform crypto trading ecosystem designed to deliver institutional-grade market intelligence, real-time narrative analytics, and instant, non-custodial execution—all from a unified and user-controlled platform.

The Challenge:

Crypto trading today is dominated by high-frequency information cycles, on-chain whale flows, and social-driven volatility. Most platforms are either fragmented or custodial, forcing users to piece together signals, manage multiple wallets, and often react too late to emerging market opportunities.

LUMI Agent: Real-World Solution

LUMI solves these pain points by combining three core pillars:

1. Institutional-Grade AI Intelligence

True Multi-Source Data:

LUMI's AI continuously aggregates and analyzes data from blockchains (ETH, SOL, L2s), DEX/CEX trades, social feeds (Twitter/X, Discord, Telegram), and news sources—giving users a live, panoramic market view.

Alpha Filtering:

Custom-trained models cut through the noise, surfacing only actionable signals: whale activity, token launches, social trends, and key technical breakouts—delivered before they hit mainstream platforms.

Narrative Analytics:

Proprietary narrative engines detect emerging themes, meme cycles, and influencer sentiment, contextualizing price moves and alerting users to the "why" behind every surge or dump.

2. Unified, Cross-Platform User Experience

Seamless Integration:

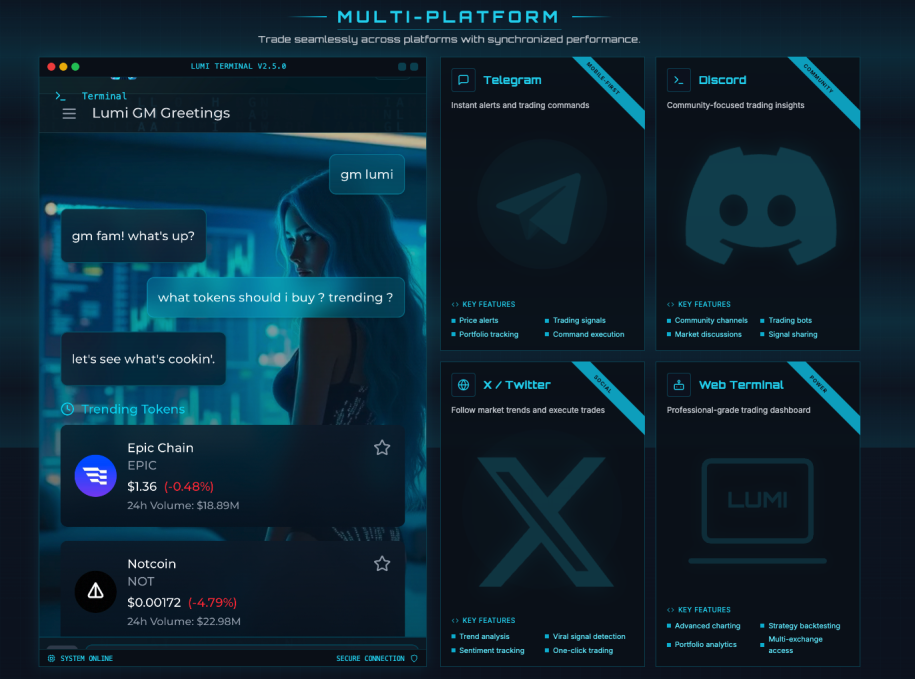

Every LUMI feature is available on Web, Telegram, Discord, and X. Signals, analytics, and trade actions are always in sync—no matter where you operate.

For Individuals & Institutions:

LUMI empowers everyone from solo traders and airdrop hunters to DAOs and crypto funds, making elite tools accessible and collaborative by design.

3. Secure, Non-Custodial Execution with Incentive-Driven Growth

Instant, Secure Trading:

LUMI's execution engine routes trades across top DEXs, CEXs, and supported chains. All trades are non-custodial—users sign with their own wallets (social login, CLI, hardware, or MPC), ensuring no platform risk. Users can onboard in seconds via social login or connect their preferred wallet for maximum security and control, with all transactions and private keys remaining encrypted and user-owned.

User Sovereignty:

Unless users interact with fiat ramps or regulatory-triggered products, they retain full privacy and autonomy with no forced KYC.

Incentivized Ecosystem:

The native $LUMI token underpins staking rewards, DAO governance, trading leaderboards, and periodic airdrops—directly aligning platform growth with user activity. Alpha sharers, signal creators, and active community members are rewarded based on transparent, on-chain participation metrics.

An all-in-one command hub where LUMI's AI engine streams live market data, narrative analytics, and instant trade execution—delivering institutional-grade intelligence through an immersive, cyber-futuristic dashboard.

Strategic Impact

With this architecture, LUMI enables users to:

- Anticipate (not chase) major market moves—gaining signal before the crowd

- Act instantly—across any channel, without ever giving up custody or privacy

- Scale securely—from single traders to institutional DAOs and funds

Market Position

LUMI enters a market where the demand for AI-native, non-custodial, multi-chain trading tools is growing rapidly. Our focus on genuine security, on-chain transparency, user-centric UX, and real-time intelligence positions LUMI as the essential backbone for both today's crypto traders and tomorrow's decentralized institutions.

LUMI Agent: The next standard for intelligent, secure, and user-controlled trading—purpose-built for the speed and complexity of modern crypto markets.

Market Opportunity & Industry Context

Crypto Market Landscape.

Global digital-asset capitalization now stands at approximately USD 3 trillion, supported by more than USD 100 billion in daily spot-and-derivatives turnover. Over eighty-percent of this volume is algorithmic or AI-assisted, and capital can rotate by the billions within five minutes of a viral tweet, Discord leak, or GitHub commit—underscoring the critical importance of speed, context, and automation.

Crypto Market Overview: Visualizing the USD 3 trillion digital-asset market and its AI-driven trading volume.

Structural Pain Points.

Despite its scale, the market still forces participants to juggle five-plus disconnected tools (chart terminals, alpha chats, wallets, DEX routers, CEX APIs). Switching between those tools introduces three-to-ten seconds of latency, eroding edge through slippage. In parallel, custodial failures such as FTX, Celsius, and BlockFi have removed over USD 9 billion from user balances (2022-2024) and shattered trust in centralized venues. Meanwhile, traders confront an information fire-hose of ten-million-plus crypto-related tweets per day, of which less than one-tenth of one percent move price, making efficient signal extraction nearly impossible.

Addressable Gap.

Annualized turnover across centralized and decentralized exchanges approaches USD 5 trillion. Capturing even a two-percent share of that flow represents a serviceable opportunity in excess of USD 100 billion—a slice currently unaddressed by legacy terminals, pure-data dashboards, or wallet-only products.

LUMI Agent Competitive Edge.

LUMI Agent closes this gap by unifying intelligence and execution in a single, non-custodial interface:

- Real-time narrative engine continuously scrapes Twitter/X, Discord, Telegram, news outlets, and GitHub, clustering keywords and memes to flag narrative spikes in under sixty seconds.

- Signal-fusion layer corroborates social activity with whale-wallet flows and liquidity shifts, auto-plots technical levels, and removes more than ninety-five percent of false positives.

- Instant, non-custodial execution enables

/buy,/sell, and/swapacross Ethereum, Solana, and leading Layer-2s from Web, Telegram, Discord, or X.

Bottom Line.

By collapsing fragmented workflows into one AI-driven, key-controlled platform, LUMI Agent unlocks a USD 100-billion-plus revenue surface that legacy solutions—limited by custodial risk, latency, and siloed data—cannot reach.

Vision, Philosophy & Core Principles

Vision

To democratize access to institutional-grade, AI-driven trading edge—empowering every market participant, from retail to professional, with the precision, speed, and insight previously reserved for the world's most advanced trading desks.

Philosophy

LUMI Agent is built on the foundational belief that the future of trading belongs to those who anticipate, not just react. By fusing quantitative analysis, real-time on-chain data, and narrative-driven market intelligence, LUMI transforms raw information into executable edge. At every step, LUMI prioritizes user sovereignty—ensuring that traders maintain absolute control over their assets, data, and strategic decisions.

Core Principles

- Multi-Platform Accessibility: LUMI is accessible wherever the community is active—seamlessly integrated into Web, Telegram, Discord, and X. No feature lag, no siloed experiences; users enjoy consistent, real-time capability across all platforms.

- Incentive Alignment: The $LUMI token ecosystem rewards active contribution, long-term participation, and network security. Staking, DAO voting, and exclusive airdrops foster a culture of aligned growth.

- Continuous Evolution: LUMI's open, modular architecture is designed for rapid innovation—adapting instantly to new market structures, emerging narratives, and user demands.

LUMI Platform Interface: The comprehensive dashboard showcases markets, leaderboards, whale tracking, and futures trading in an intuitive, visually striking design.

Problem Statement & User Needs

Trader's Realities: The Modern Market Landscape

1. Information Overload and Signal Saturation

Crypto traders face an unprecedented volume of information. Relevant market-moving data pours in from:

- Twitter/X (whale alerts, influencer calls, breaking news, community sentiment)

- Discord/Telegram (alpha groups, coordinated raids, meme pumps, project announcements)

- 24/7 News Feeds (CoinDesk, The Block, CryptoPanic, and dozens of niche aggregators)

- DEX/CEX and On-Chain Alerts (wallet trackers, new pools, volume spikes, token launches, rug pulls)

- Wallet and NFT Activity (multi-chain portfolio movements, sudden listings, whale sweeps)

The challenge is not just collecting this data, but filtering what actually matters—before the market reacts.

The Problem: Crypto trading is broken by information overload, market volatility, 24/7 markets, and emotional trading—four key pain points that stall performance and erode returns.

2. Whale-Driven Volatility and Smart Money Speed

The majority of significant price action is triggered by a small number of high-value wallets ("whales") or coordinated trading groups ("smart money"). These entities:

- Move capital across chains and DEXs in seconds, front-running retail traders and often orchestrating narrative shifts to amplify their edge.

- Deploy algorithmic bots for sub-second execution—impossible for any manual trader to match.

- Routinely exploit fragmented liquidity and human reaction lag to extract outsized gains.

3. Narrative-Led Price Movements

- Major tokens and memecoins can move 20–100% based solely on social momentum, memes, and influencer pushes, well before technical setups appear on the chart.

- By the time retail or even most bots react to a technical breakout, the narrative-driven price move is already in progress or complete.

- New token launches, protocol upgrades, and "viral" airdrop rumors can create micro-bull cycles within minutes.

4. Fragmented Execution & Custody

Traders are forced to juggle multiple tools: analytics dashboards, Twitter scanners, trading bots, custodial wallets, and centralized exchanges—each with its own latency and risk.

Most solutions are siloed: bots lack true narrative AI, wallet apps lack instant execution, and cross-chain interoperability is limited.

LUMI Ecosystem Map

LUMI Agent operates as a highly modular, distributed platform—anchored by a central AI agent and designed for extensibility, resilience, and high-frequency market environments. The ecosystem enables users to access institutional-grade analytics, narrative intelligence, and secure trading from any major digital channel.

System Architecture

LUMI Core Engine connects to Web, Telegram, Discord, and X agents. Data Aggregation layer ingests blockchains, exchange APIs, and social/news sources.

+-------------------------+

| LUMI Web Terminal |

+-------------------------+

| | | |

+---------------------+ | +-----------------------+

| | |

+--------+ +------------+ +-----------+

|Telegram|<--->API<---> | Core | <---API---> | Discord |

| Agent | | LUMI | +-----------+

+--------+ | Agent |

| Engine |

+------------+

|

+-------------+

| X Agent |

+-------------+

|

+---------------------+

| Data Aggregation |

+---------------------+

|

+---------+--------+---------+---------+---------+

| | | | | |

[ETH] [SOL] [L2s] [BSC] [DEX/CEX APIs] [Social Feeds]User-Facing Platforms

Web Terminal

Overview:

The main portal for the LUMI ecosystem, delivering a professional, browser-based trading environment.

Features:

- Interactive Dashboard: Unified overview of portfolio performance, market trends, and live alerts.

- Advanced Analytics: Visualize price action, on-chain metrics, and wallet flows across multiple chains.

- Live Charting: Institutional-level chart tools, real-time technical indicators, and automated pattern detection.

- Trade Execution: Non-custodial, multi-chain trading with integrated risk controls, slippage, and routing optimization.

- Personalization: Custom widgets, notification preferences, and strategy management.

Telegram Agent

Overview:

Lightweight, command-driven interface for fast mobile and desktop trading on-the-go.

Capabilities:

- Signal Delivery: Real-time alpha drops, whale alerts, and narrative shifts delivered as chat notifications.

- Instant Trading: Execute trades with simple text commands (/buy, /sell, /swap) directly in chat.

- Wallet Operations: Check balances, generate deposit/withdrawal addresses, and monitor transaction history.

- Security: User authentication via Telegram OAuth, optional 2FA, and CLI wallet integration.

Reference: TG Bot Documentation

Discord Agent

Overview:

Deep integration with community servers, ideal for DAOs, trading groups, and on-chain communities.

Key Functions:

- Advanced Analytics: Market recaps, gainers/losers, and on-chain sentiment displayed in server channels.

- Wallet Connect: Seamless linking of Discord accounts to user wallets for direct command execution.

- Signals & Alerts: Push notifications for major price moves, volume spikes, and narrative trends.

- Airdrop & Role Management: Role assignment based on wallet holdings, activity, and airdrop eligibility.

Reference: Discord Agent Docs

X (Twitter) Agent

Overview:

Social narrative and trending analysis, ideal for capturing meme cycles and influencer momentum.

Core Features:

- Narrative/Trending Analytics: Detects and surfaces fast-moving trends, key hashtags, and influential accounts.

- Sentiment Scoring: Evaluates tweet tone, volume, and engagement to quantify bullish/bearish social flows.

- Event Alerts: Notifies users of breaking stories, market-moving tweets, or coordinated social campaigns.

LUMI's market intelligence and execution tools are delivered natively across Telegram, Discord, X / Twitter, and a professional-grade web terminal—ensuring users receive synchronized insights, alerts, and trade commands on every device and channel they prefer.

Reference: X Agent Docs

Platform Functionality Overview

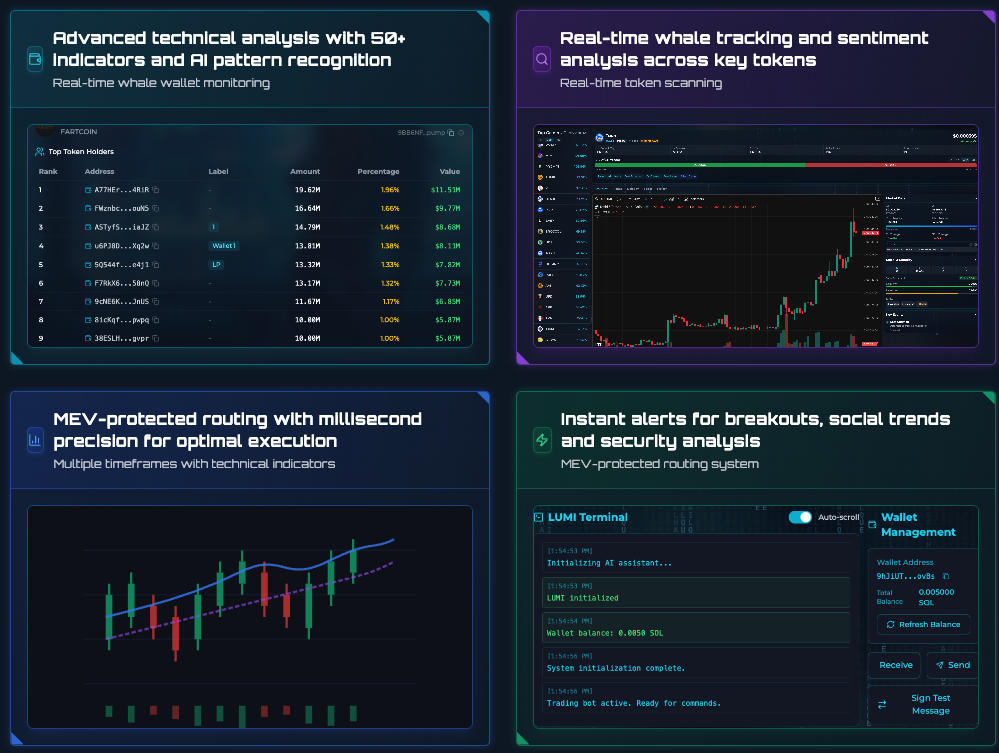

Comprehensive Technical Analytics

The terminal integrates more than fifty industry-standard indicators together with machine-learning pattern recognition. Built-in whale-wallet monitoring supplies continuous visibility into large-holder behaviour and liquidity shifts.

Real-Time Whale & Sentiment Tracking

A live scanning engine aggregates on-chain flows and social data to identify notable token inflows/outflows and sentiment inflection points across major assets, providing early-stage market intelligence.

MEV-Protected Smart Routing

Orders are executed through a latency-optimised routing layer that mitigates Miner/Maximal Extractable Value (MEV) and slippage. The system dynamically selects venues (DEX/CEX) based on millisecond-level price and depth analysis across multiple time frames.

Event-Driven Alert Framework

Users receive configurable notifications—covering technical breakouts, social-momentum spikes, and security anomalies—through in-terminal pop-ups, push messages, or SMS. All alerts are powered by the same MEV-hardened infrastructure that governs execution.

Core Execution & Intelligence Modules

(a) Advanced technical suite with 50+ indicators and AI pattern recognition

(b) Real-time whale-flow and sentiment scanner across priority tokens

(c) MEV-shielded smart-order router delivering millisecond-level execution

(d) Event-driven alert layer for breakouts, social trends, and security anomalies

Back-End Infrastructure

Data Layer

- Multi-Chain Connectivity: Aggregates blockchain data across Ethereum, Solana, major L2s, and BSC, enabling full-spectrum analytics and token tracking.

- Exchange APIs: Real-time price, volume, and order book data from leading DEXs and CEXs (e.g., Binance, Uniswap, Jupiter).

- Social & News Integration: Scrapes, indexes, and semantically parses data from Twitter, Discord, Telegram, and leading crypto news sources.

- Resilience: Built-in failover, redundancy, and low-latency processing to ensure zero downtime and real-time responsiveness.

AI/Analytics Engine

- Custom LLMs: Proprietary language models trained on financial, technical, and social data for narrative detection and pattern recognition.

- Quantitative Models: Statistical and machine learning algorithms for volatility prediction, whale tracking, and sector rotation.

- Technical Analysis Engine: Automated chart pattern recognition, support/resistance plotting, and backtesting modules.

Wallet Module

- Social Login: One-click wallet creation via Google, Discord, Telegram, or Apple for rapid onboarding.

- CLI/Hardware/MPC Support: For power users, enables advanced custody options including command-line and hardware wallet management.

- End-to-End Encryption: All private keys and sensitive operations secured with modern cryptography; optional multi-factor authentication for critical actions.

- Multi-Asset Support: Manages and tracks assets across all supported blockchains and tokens, including NFTs and staked positions.

Tokenomics & Governance Module

- Rewards: Automated distribution of staking yield, participation bonuses, and community engagement rewards in $LUMI tokens.

- Staking: Users can stake $LUMI to access premium features, higher signal tiers, or DAO voting power.

- Governance (DAO): On-chain, transparent governance proposals and voting, with multisig treasury management.

- Airdrop & Leaderboard Engine: Tracks user engagement and activity for dynamic, merit-based airdrop distribution and competitive leaderboards.

LUMI's architecture is intentionally open and extensible, designed to support rapid integration of new protocols, platforms, and analytics modules as the crypto landscape evolves. Each layer is optimized for speed, security, and composability, making LUMI the ideal hub for both individual traders and institutional-grade digital asset operations.

AI Market Intelligence Engine

Aggregates on-chain, exchange, and social data to surface volatility, whale moves, and narrative shifts.

LUMI Terminal: integrated AI-driven trading workspace

A single interface combines real-time market visualization, AI-powered trade recommendations, automated strategy execution, and personalized insights—allowing traders to monitor data, act on signals, and route orders within one secure environment.

Example Output Types

| Output | Cadence | Contents |

|---|---|---|

| Momentum Alert | sub-second | BTC breaks 20-day upper Bollinger (+2.4 σ), whale inflow 4.1 k BTC (Glassnode) — breakout probability 78 %, target $102 k |

| Narrative Surge | 3 min | "$WATER" mentions +680 % on X, sentiment 0.82 (very positive), funding flip long — watch for liquidity squeeze. |

| Smart-Money Sweep | on-chain block | 0xA2… bought 12.5 M $SOL via Jupiter; historical win-rate 71 % — token list: SOL, PYTH follow buys possible. |

Governance & Quality Controls

Model versioning – MLflow; promotion requires back-test Sharpe ≥ previous + 5 %.

Shadow mode – new models run side-by-side for two weeks; alerts gated until outperform.

Ethics & security – Differential-privacy noise on volume metrics; no personal-identifiable social data stored.

This engine supplies LUMI with millisecond-grade, explainable intelligence that feeds directly into routing, strategy automation, and user dashboards, ensuring traders receive timely, defensible signals rather than noise.

Technical Analysis Module

Detects patterns, plots support/resistance, and generates trade plans with backtesting.

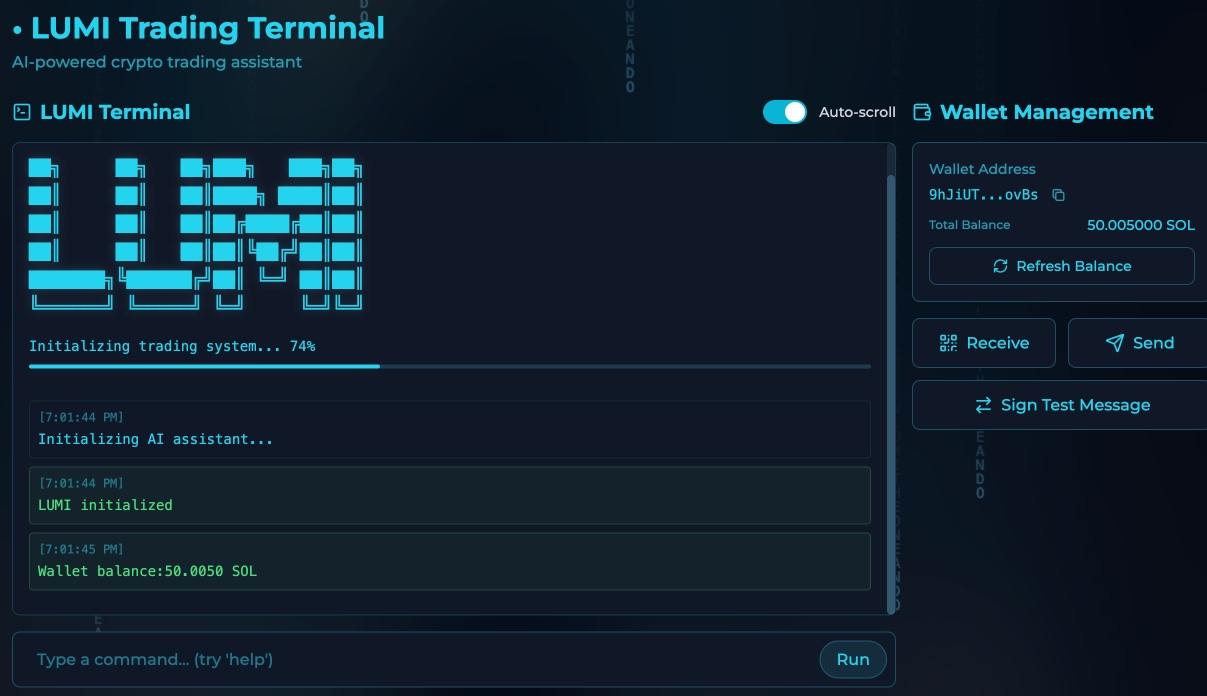

LUMI Trading Terminal start-up sequence

The terminal's command console and integrated wallet panel during system initialization: the AI assistant comes online, synchronizes balances, and prepares the account for secure trade execution.

🔧 Core Features

Drag-and-Drop Charting

Customize your layout effortlessly. Resize, overlay, and arrange charts the way you want — optimized for rapid technical setups.

📊 Analyze Indicators

Instantly get in-depth analysis on technical indicators like trendlines, moving averages, volume overlays, RSI, MACD, and Fibonacci retracements — all with a single click.

🔍 Auto Support & Resistance Detection

LUMI highlights key horizontal levels based on price history and volume clusters — instantly identifying high-probability zones.

📈 Candlestick Pattern Recognition

LUMI scans live charts for reversal and continuation patterns (e.g. hammer, engulfing, double top), helping you catch pivots in real time.

🧠 AI-Powered Setup Analysis

Drop in any chart screenshot, and LUMI will break down trend direction, risk levels, targets, and entry probability — complete with confidence scoring.

Bitcoin trade setup view in the LUMI Terminal

The comprehensive trade panel displays Bitcoin at $95,087 with precise entry ($93,500), stop-loss ($91,500), and target ($98,000) levels. The system calculates a favorable 9:4 risk/reward ratio with +4.81% potential gain and shows a "Strong Buy" signal (83%) based on technical indicators including the 20-day SMA positioning above the 200-day SMA and positive RSI momentum.

Token Analytics & Whale Tracking

Overview

LUMI provides deep, real-time transparency into token movements, whale activity, and on-chain risk—empowering traders to front-run major flows and avoid rug-pull scenarios.

Key Capabilities

Live Wallet Clustering & Monitoring

- LUMI continuously clusters wallets by behavior, linking new addresses to known whales, smart money, or exchange flows using advanced heuristics and machine learning.

- Tracks historical movements, net inflows/outflows, and wallet "age" (new vs. seasoned participants).

Whale Alert Triggers

- Automated triggers for high-impact on-chain events such as:

- $500K+ transactions (configurable per token)

- Sudden inflows or outflows from top wallets

- Creation of new large wallets entering a token (often smart money)

- Unusual transaction patterns or splits (potential OTC deals or orchestrated pumps)

- Alert types: Discord/Telegram push, Web pop-up, or even on-chain alert transactions.

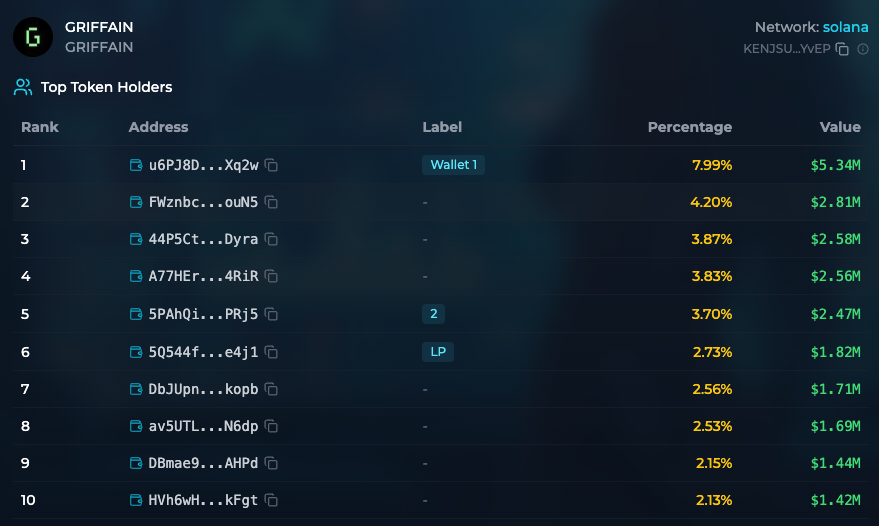

Top-Holder Concentration Audit for GRIFFAIN (Solana)

Snapshot of the ten largest wallets reveals the leading address controls 7.99% of supply (~ $5.34M), while the next nine each hold between 2%-4%, indicating moderate decentralization and limited single-wallet dominance.

Token Launch & Rug Risk Scanner

- LUMI detects new pools, liquidity injections, or rapid TVL changes.

- Runs real-time contract checks: source code, admin privileges, blacklist match, time-locked liquidity, and creator wallet pattern.

- Flags suspicious activity and scores risk, alerting users of likely rug pulls or scams.

Tokenomics & Incentive Design

LUMI Token — Current Tokenomics Snapshot

| Metric | Value | Notes |

|---|---|---|

| Chain | Solana (SPL) | Gas-efficient, lightning-fast |

| Max Supply | 1,000,000,000 LUMI | Hard-capped |

| Circulating Supply | 1,000,000,000 LUMI | Full float at TGE |

| Buy / Sell Tax | 5% | Allocated below |

Tax Distribution

| Allocation | Rate | Purpose |

|---|---|---|

| On-chain Agent Wallet | 1% | Funds AI upgrades, on-chain ops, transparent multisig |

| Marketing & Growth | 1% | CEX listings, campaigns, KOL pushes |

| Community Rewards | 2% | Auto-distributed to AI agents & staking participants |

| Buyback & Burn | 1% | Programmatic market buybacks → burn wallet |

Deflation Strategy

- Buyback & Burn – Monthly burns from treasury-acquired tokens

- Buyback & Lock – Portion of revenue cycles into treasury, locked permanently

- LUMI Lock – Locking boosts staking APY, reducing circulating float

LUMI Token Ecosystem: Built on Solana with 1 billion max supply and a 5% tax structure that funds platform development, marketing, community rewards, and token burns to create sustainable deflationary pressure.

Multilingual Expansion Strategy

LUMI's intelligence engine is being internationalised to capture high-growth, non-English crypto markets.

| Parameter | Target |

|---|---|

| Supported languages (EOY 2025) | 10+ |

| Addressable user base | 3 billion+ potential users |

| Average monthly engagement uplift | +215% |

Priority Language Roll-Outs

| Locale | Native-Language Reach | Go-to-Market Funnel |

|---|---|---|

| Chinese (CN) | 1.28 billion speakers | WeChat community → Discord staging → LUMI Terminal; content authored natively in Mandarin. |

| Brazilian Portuguese (BR) | 265 million speakers | Telegram-first agents distribute market intelligence in Portuguese before syndicating to Terminal. |

| Arabic (MENA) | 420 million speakers | Dubai operations hub under construction; Arabic interface and support for regional exchanges and OTC desks. |

Auto-Translation Network

All analytical outputs—narrative alerts, whale-wallet signals, execution prompts—are machine-translated and mirrored into language-specific channels (e.g. #lumi-alpha-chinese, #market-intel-portuguese, #whale-alerts-arabic). Early pilots have produced measurable engagement gains:

| Region | Engagement Lift* |

|---|---|

| Chinese | +85% |

| Portuguese | +72% |

| Arabic | +63% |

*Increase in daily active users and message volume versus English-only baseline.

One intelligence engine, multiple languages—designed for truly global scale.

Global Language Expansion: LUMI's strategy to scale across borders with 10+ languages by EOY 2025, reaching 3B+ potential users with targeted approaches for Chinese, Brazilian Portuguese, and Arabic markets, resulting in significant engagement boosts across all regions.

Roadmap & Milestones

LUMI Agent — 18-Month Roadmap

(baseline = Apr 2025 · conferences locked in)

| Quarter | Key deliverables & dated conference appearances | KPI targets* |

|---|---|---|

| Q2 2025 |

| — |

| Q3 2025 |

|

|

| Q4 2025 |

|

|

| Q1 2026 |

|

|

| Q2 2026 |

|

|

| Q3 2026 |

|

|

| Q4 2026 |

| — |

The Future Vision

LUMI is being engineered to serve as the infrastructure layer for next-generation, decentralised trading—a platform where human insight and autonomous AI agents interact seamlessly across chains, devices, and market venues. Built on the staged roadmap outlined above, the end-state is defined by five strategic pillars:

Cross-Chain Liquidity Layer

By Q4 2025 LUMI routes spot orders across Solana, Ethereum mainnet, and two leading L2s. This architecture expands in 2026 to cover on-chain perpetuals and emerging ecosystems, allowing traders and strategies to source the best price, depth, and execution guarantees regardless of network.

Unified AI Trading Stack

The Autonomous Trading Engine (go-live Q3 2025) ingests technical signals, social momentum, and flow data, then sizes and fires orders in milliseconds. In 2026 this engine extends to derivatives, portfolio rebalancing, and meme-scalp workflows, delivering a single risk kernel that powers spot, perps, and strategy bots with equal discipline.

User-Centric Interfaces Everywhere

- Web & API – professional terminal, programmatic endpoints, and >100 third-party integrations (target Q1 2026).

- Mobile & Chat Bots – tap-to-trade commands inside Telegram/Discord.

- LUMIVERSE – a VR metaverse trading floor (alpha Q2 2026, public beta Q3 2026) where portfolios, order books, and voice stages coexist in an immersive environment. Users can collaborate, back-test, and deploy strategies in real time.

Marketplace & Academy Flywheel

The Strategy Marketplace (Q2 2026) lets quants monetise algorithms while everyday traders subscribe to proven systems. Each marketplace release is paired with LUMI Academy content—expanding from technical-analysis basics to narrative trading, derivatives, and ultimately metaverse onboarding—ensuring continual skills progression and platform stickiness.

On-Chain Capital Formation

Launching in Q1 2026, the AI-Agent VC Fund enables governance token-holders to seed promising strategies and DeFi primitives directly from the LUMI interface. Profits, performance data, and risk metrics live on-chain, creating a transparent feedback loop between capital providers and algorithmic talent.

North-Star Outcome (Q4 2026)

- $800 M+ cumulative trading volume processed through LUMI's cross-chain router.

- 1 M daily active users spanning web, mobile, and VR.

- An ecosystem where any trader—from retail scalper to institutional desk—can spin up an AI agent, tap the deepest liquidity, and execute with institutional-grade latency, security, and compliance, all without leaving the LUMI stack.

In short, LUMI's vision is to graduate from a powerful trading terminal into the backbone of decentralised, autonomous finance—one that scales with the markets, educates its users, and unlocks borderless opportunity for every participant.

Social Narrative & Sentiment Engine

Overview

LUMI's AI narrative engine continuously monitors, parses, and ranks market-moving social and news data—turning chaos into actionable narrative edge.

Key Capabilities

Comprehensive Monitoring

Keyword & Meme Velocity

Influencer Sentiment & Bot Detection

Narrative Heat Score

LUMI's integrated dashboard combines Neural Feed analysis, Whale Tracker alerts, and Market Intelligence in a unified interface. The system monitors token movements, price surges, and market trends in real-time, providing actionable insights for traders.